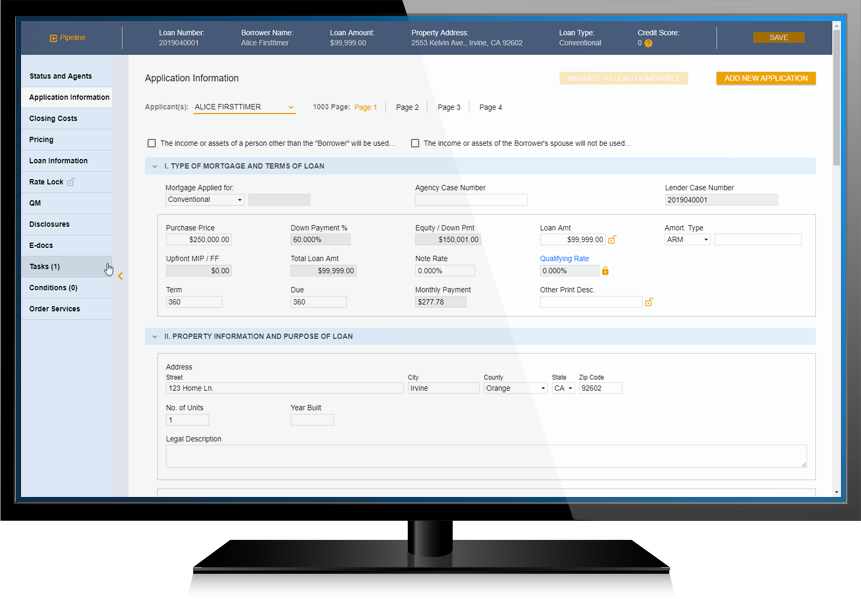

Industry leading mortgage origination software.

Cut mortgage loan origination costs and reduce cycle times by leveraging industry’s leading web-based mortgage loan origination system.

LendingQB is a SaaS-based system end-to-end mortgage origination software equipped with automated pricing and underwriting engine that speeds up decision times and improves productivity.

LendingQB's Open API connects to more than 300 integration products ranging from point-of-sale, compliance, e-closing, and more. This ensures a streamlined workflow and the elimination of manual work.

From 20 to 2000 mortgage loans per month, LendingQB's comprehensive web-services and configurability mean lenders don't have to sacrifice their unique workflows. Configure the system to work based on your unique business rules.

LendingQB's PriceMyLoan Product Pricing Engine was built natively in the LOS and is considered to be a true Automated Underwriting System (AUS).

Live chat, phone support, and a knowledge base ensure that lenders never miss a beat. Highest rated in online help & help desk support by STRATMOR's Technology Insights Report.

LendingQB includes an automatic check for 0-10% TRID Tolerance and features State & Federal compliance, along with HMDA & NMLS Data compliance built directly into the system.

iServe Residential Lending

Inlanta Mortgage

3560 Hyland Ave, Suite #200

Costa Mesa, CA 92626

T: 866-417-5130