Empowering financial institutions to stay competitive with the industry’s leading loan origination system.

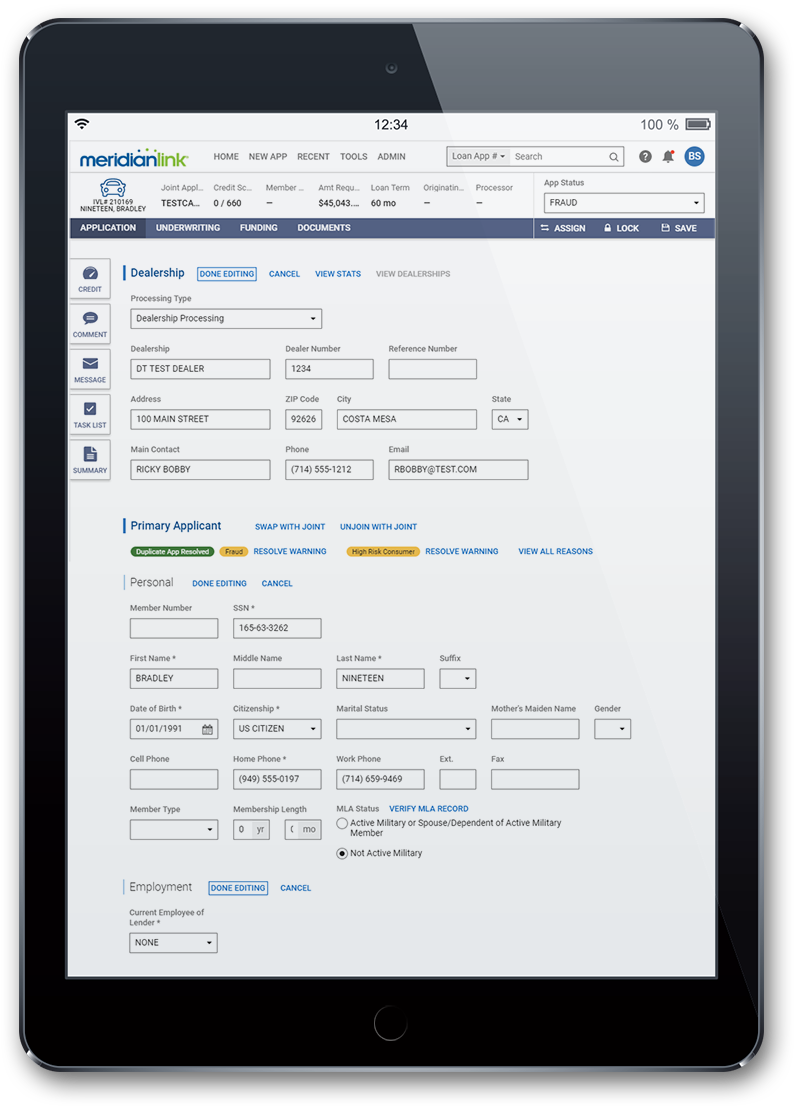

Consolidates mobile, branch, call center, indirect, retail, and kiosk applicants into one easy-to-use SaaS processing system. Resulting in lower IT costs and painless upgrades.

Equipped with automated underwriting, pricing, and cross-selling for indirect loans (auto and retail), consumer lending (direct auto, unsecured, and secured personal loans), LOCs, business loans, home equity loans and HELOCs, and vehicle leases.

Allows for customization by integrating to over 200 third party choices, and a tailored application experience with more than 1000 preferences encompassing data field collection and system behavior.

Utilizing a single origination system to process all applications creates a streamlined and efficient approach to loan originations. Efficient processes create reproducible outcomes, cross selling opportunities, and increase branch revenue.

Through the alleviation of manual work, automated decisioning, and notification features our partners can focus on fostering membership and customer relationships and providing great service to their communities.

LoansPQ automates processes and creates consistency in day-to-day work which significantly reduces time spent on processing applications resulting in reduced operational costs.

Security Service Federal Credit Union

Rod Early – SVP, Scored Credit Analytics Manger

Diane Kapuranis – Vice President, Lending

3560 Hyland Ave, Suite #200

Costa Mesa, CA 92626

T: 866-417-5130